This post was originally published on April 30th, 2007. It was imported from a previous version of the site.

Coming on the heels of my look at the overall ETF market in the last three months, and using the same data set, this entry is meant to provide an overview of the country-specific MSCI ETFs.

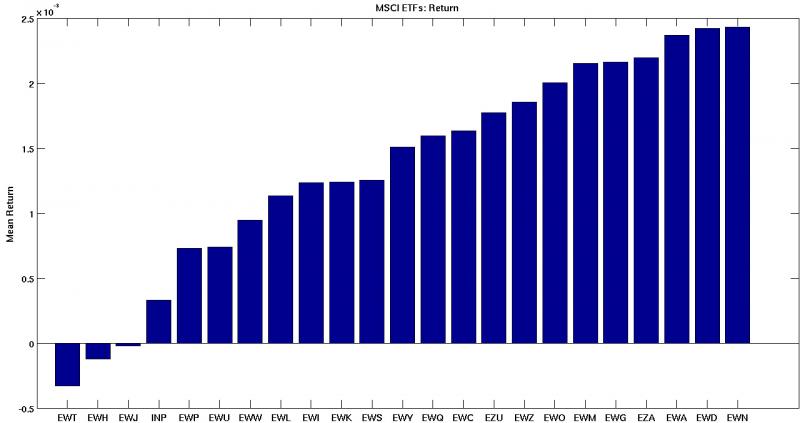

So the average MSCI ETF gained about 0.14% daily, with the Netherlands in first and Taiwan in last. The trend is relatively clear – most economies have seen solid growth, while Taiwan, Hong Kong, and Japan have struggled to tread water. It’s interesting to note that the same issues do not seem to have affected Singapore, Malaysia, or Korea.

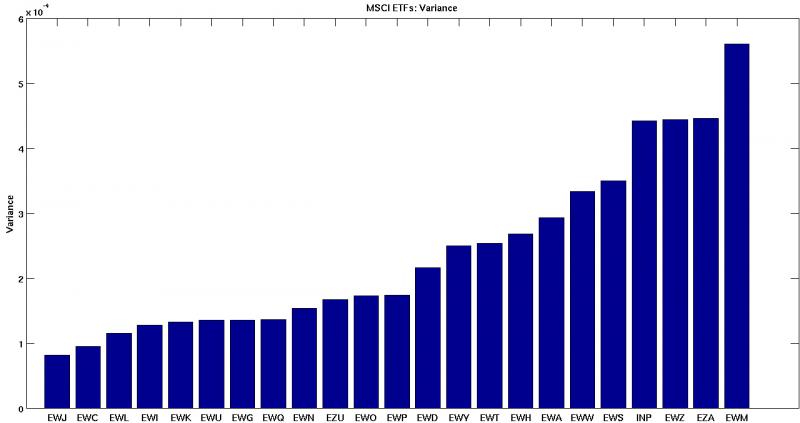

As far as volatility goes, Malaysia clearly leads the pack, with South Africa, Brazil, and India close behind. On the other end, all seems quiet for Japan and Canada, as well as most of the European economies.

Overall, it looks like as far as the MSCI is concerned, Europe gives higher yield with less risk compared to any of the BRICS acronym variants (Brazil, India, S. Africa, Mexico, etc.). Whether this trend will continue is another question, especially given the recent rise of lending rates, but it’s hard not to price in the relative stability of western European countries like the Netherlands when compared to Malaysia.