In the next day or two, I’m hoping to produce some comprehensive research (at least comparatively in the blogosphere) on the relationship between the S&P 500 and the Federal Reserve’s permanent open market operations. Historical data for these operations is available back to August 2005.

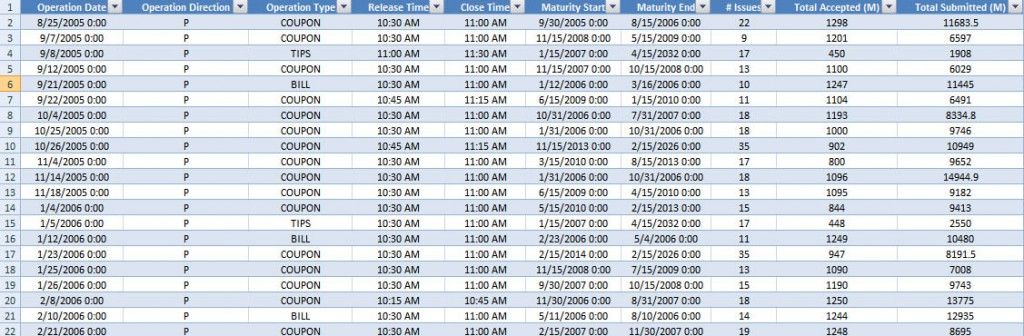

In order to do this, I needed to get the Fed’s POMO data into a much more reasonable format. The spreadsheet below is the result of my work. You can download the spreadsheet here.

As an added bonus, I’ve decided to release the Python code I used to process the NYFRB’s XML data (you’ll need lxml, too). Here it is below: