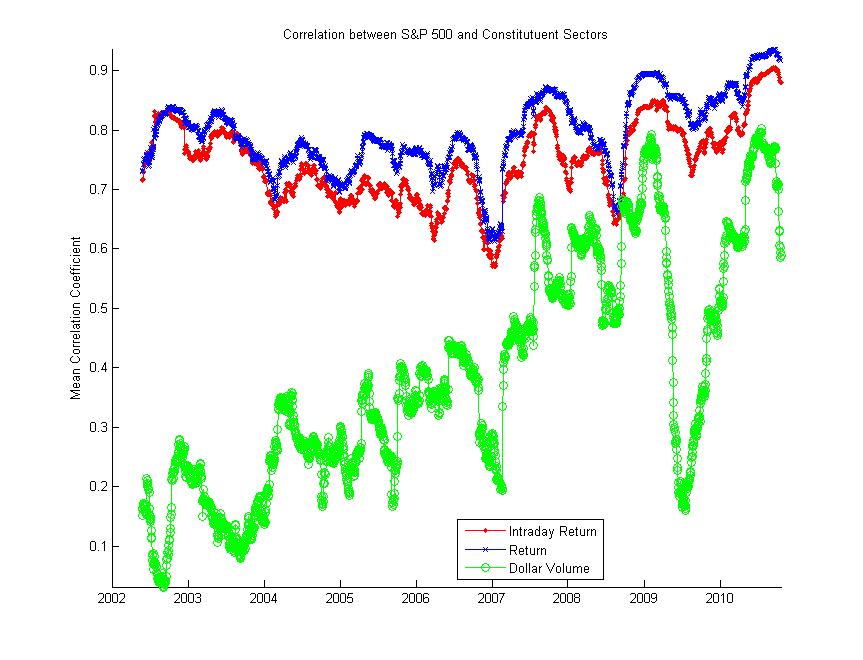

Here’s a paper out of the CabDyn group at Oxford from D. Fenn and M. Porter. Mason is also one of the leading researchers in network science, and their group has entered into a number of joint Ph.D./post-doctoral hires with the business school there. The result is a large number of interesting papers. This particular paper investigates correlation matrices through RMT, which is exactly what my Quantitative Finance paper and recent working paper address. Though they don’t examine their calculations in an applied context, the results provide additional view into recent correlation dynamics. Abstract and download below:

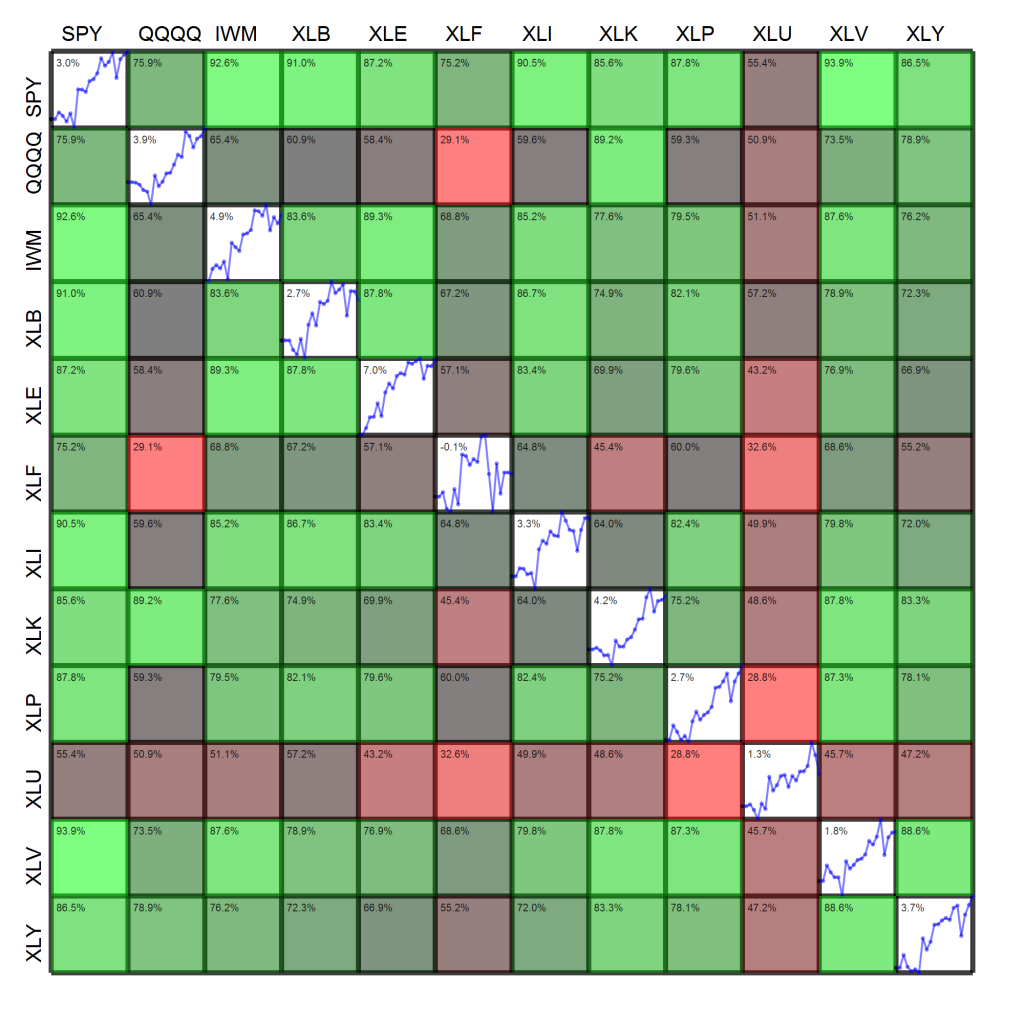

Abstract: We investigate financial market correlations using random matrix theory and principal component analysis. We use random matrix theory to demonstrate that correlation matrices of asset price changes contain structure that is incompatible with uncorrelated random price changes. We then identify the principal components of these correlation matrices and demonstrate that a small number of components accounts for a large proportion of the variability of the markets that we consider. We then characterize the time-evolving relationships between the different assets by investigating the correlations between the asset price time series and principal components. Using this approach, we uncover notable changes that occurred in financial markets and identify the assets that were significantly affected by these changes. We show in particular that there was an increase in the strength of the relationships between several different markets following the 2007–2008 credit and liquidity crisis.

D. J. Fenn, M. A. Porter, S. Williams, M. McDonald, N. F. Johnson, N. S. Jones. Temporal Evolution of Financial Market Correlations. http://arxiv.org/abs/1011.3225.