“Faith-based” investing, a close cousin of “socially responsible” investing, has received an increasing amount of attention over the past decade. Though both of these trends have been adversely affected by the recent downturn, I thought we’d check in to see how the family of funds issued by FaithShares Advisors, LLC has fared year-to-date. FaithShares offers funds for five “different” faiths – Catholic, Lutheran, Methodist, Christian, and Baptist values.

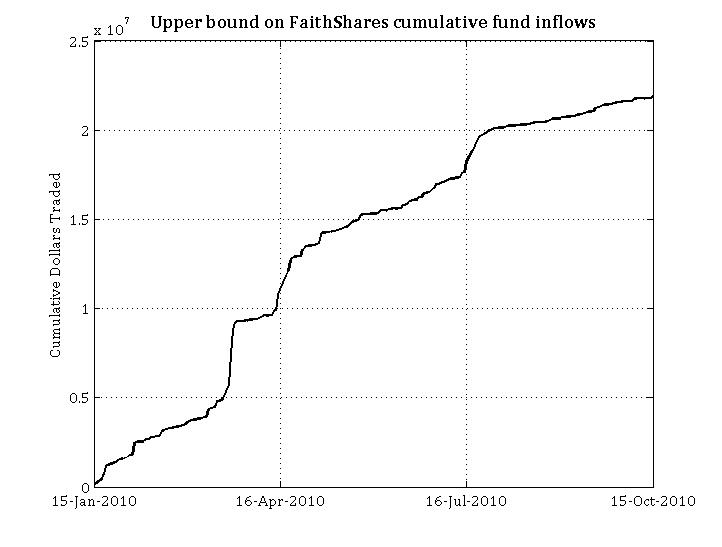

The first figure belows shows the upper bound on fund inflows since January 15th. The upper bound logic is based on the following two tricks. First, I’ve calculated dollars traded based on each day’s price high. Second, if you assume that every share traded represents an inflow and not an outflow, then the number of dollars traded represents the maximum possible inflow. The first figure below shows that this upper bound is just under $22 million dollars.

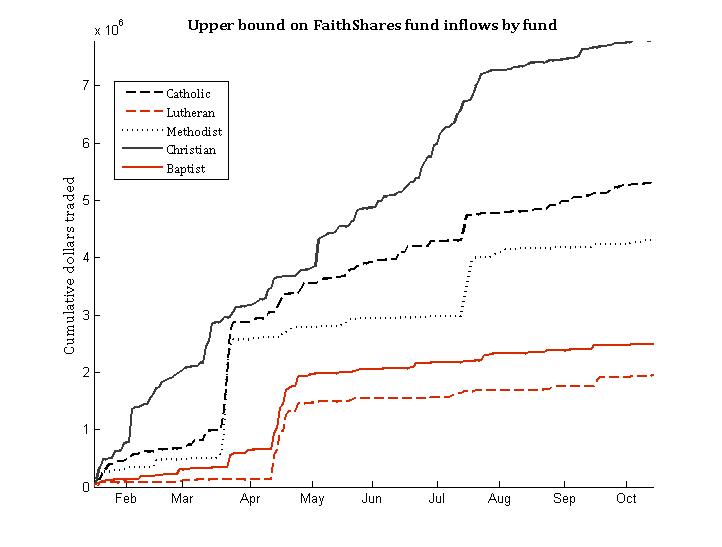

The second figure shows this upper bound on inflows by each faith. The broad, Christian based fund appears to have attracted the most interest with an upper bound of $7.78M. The Catholic and Methodist funds follow far behind with upper bounds of $5.35M and $4.30M respectively. The Baptist and Lutheran funds round out the pack with a respective $2.49M and $1.96M.

To put this into perspective, more dollars are usually traded in SPY in the first 10 seconds after 9:30AM. If you’re interested in more of the details on the internal management of these funds and FaithShares Advisors, LLC, please refer to their last Certified Shareholder Report on EDGAR.