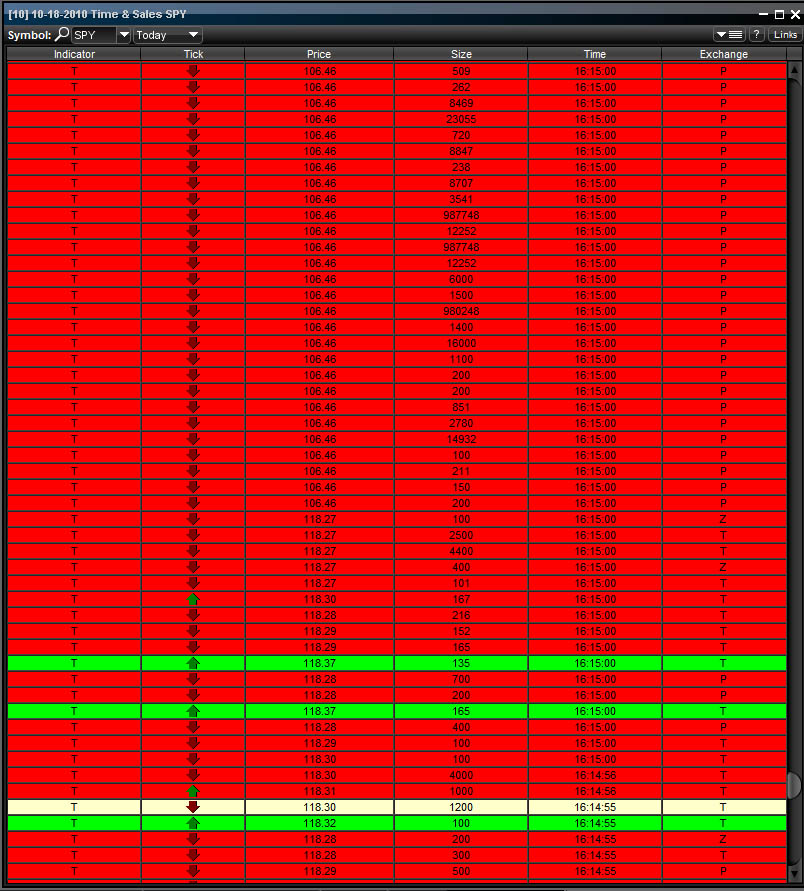

At exactly 16:15:00 today, the SPDR S&P500 ETF SPY, one of the most traded equity assets in the world, experienced a flash crash. The first 15 trades in this second executed between 118.25 and 118.40. However, the next 150 trades were executed at 106.46, 10.5% lower than the previous transactions. Within less than a single second, just under $500M in notional value traded hands at this flash crash price. The figure below shows the first of these transactions, all of which went through on exchange P, the Pacific Stock Exchange.

Not much was publicly known between 16:15pm and the release of a Bloomberg article claiming that NYSE Euronext had ruled on cancelling these orders (subject to appeal). As of 19:00 EST, there is still an 800 share bid at 106.46.

It will be interesting to see in the coming days whether anyone comes forward to appeal these busts. A comment at ZeroHedge already suggests that these trade cancellations don't meet the SEC's policy.