Data has driven finance forward in ways that theory alone could not have. In recent years, a similar trend has developed in the study of law, especially within fields such as “law and economics” or “empirical legal studies.” I find this “data-driven” approach to law fascinating (having been introduced to it by Dan), and have been active in a number of projects on the topic.

The paper below, which is forthcoming in the Virginia Tax Review (one of the top three tax reviews), is an excellent example of this trend. In it, we examine a number of aspects of the population of the Tax Court’s written decisions. Obtaining and analyzing these decisions required a significant degree of technical sophistication, and interpreting the results in their legal context has provided a number of insights. The abstract is below:

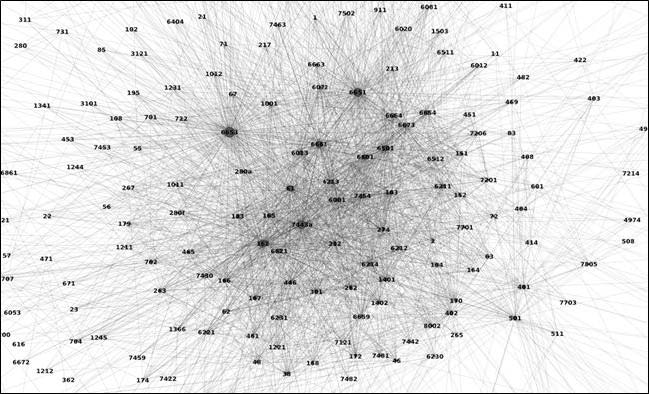

Abstract: What can empirical data tell us about the jurisprudence of United States Tax Court? Which sections of the Internal Revenue Code are most frequently cited and has recent tax legislation sparked change in the Tax Court’s decisions? This article presents an analysis of the citation practices of the United States Tax Court between 1990 and 2008. While previous citation studies focus on case-to-case citations, we modify this approach to focus on statutory citations, which better capture the nature of tax jurisprudence. By applying techniques from computer science, we collect and analyze more than 11,000 decisions and 244,000 statutory citations authored by the United States Tax Court between 1990 and 2008. Our approach includes both a static and longitudinal analysis of the most cited Internal Revenue Code sections. In addition, we carry out a network analysis of these case-to-statute citations to uncover patterns in citation practices, concept relationships, and legislative acts. This article answers the call for greater empiricism in tax scholarship and paves the way for future research on Tax Court jurisprudence.

M. J. Bommarito II, D. M. Katz, J. Isaacs-See. An Empirical Study of the Population of United States Tax Court Written Decisions (1990- 2008). Forthcoming, Virginia Tax Review, 2010. http://ssrn.com/abstract=1441007.