Another week in the black for the market, though only barely for most indices. The list of big movers this week is an interesting one.

In the green, we have exchange-traded funds for cotton (BAL), 2x inverse Brazil (BZQ), coffee (JO), 3x real estate (DRN), and 2x inverse silver (ZSL). Interestingly, cotton, Brazil, coffee, and silver are all commodity or export-based assets that are strongly affected by the dollar. However, the direction of their movement varied (remember, ZSL is inverse silver).

The red side of the table features 3x inverse real estate (DRV), 2x BRICs (BRIL), 2x Brazil (UBR), natural gas (GAZ), and short-term VIX (VXX). DRV, BRIL, and UBR all correspond to funds on the green side of the table. However, the natural gas ETF (GAZ) and VIX ETF (VXX) do not have corresponding products in the green.

VXX especially has been labeled a “bad” product (see agwarner’s latest in his ongoing crusade against VXX). I would tend to agree with Adam, as a number of VXX calls I recently held expired OTM despite what would have been a profitable trade on the underlying futures.

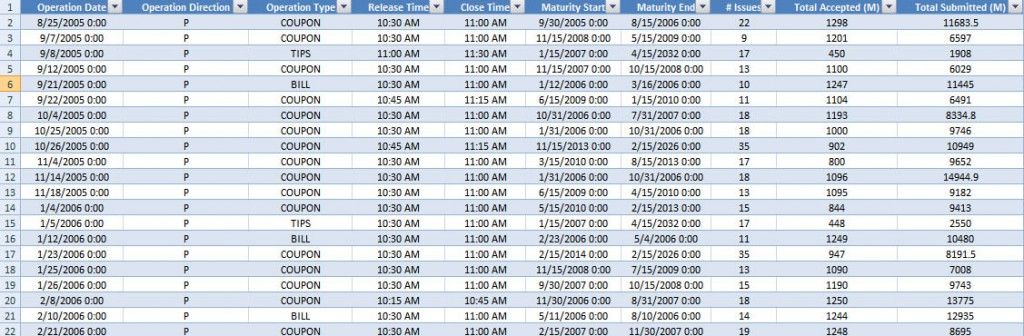

| Symbol |

Return |

$ Volume |

| BAL |

9.7% |

15M |

| BZQ |

9.4% |

12M |

| JO |

6.3% |

7M |

| DRN |

6.3% |

284M |

| ZSL |

6.3% |

86M |

| DRV |

-7.5% |

140M |

| BRIL |

-7.6% |

1M |

| UBR |

-10.3% |

4M |

| GAZ |

-11.2% |

7M |

| VXX |

-12.7% |

2.6B |

Since we’re in for a few weeks driven by domestic data and possible market exogeneities (e.g., G-20, France, U.S. politics), look for these ETFs to continue their dramatic moves.